As of 2025, the maximum monthly SSDI benefit is $4,018. Achieving this maximum requires a consistently high earnings record over a 35-year career. It’s important to note that few beneficiaries qualify for this maximum amount, as it necessitates earnings at or above the Social Security taxable maximum for most of one’s working life.

Before applying for Social Security Disability, many claimants question how much they will receive monthly and how disability benefits are calculated. In this post, we’ll walk you through the calculations the Social Security Administration (SSA) uses for their Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) programs.

Overview of SSDI Benefits

SSDI is a federal program designed to provide financial assistance to individuals who are unable to work due to a qualifying disability. Unlike Supplemental Security Income (SSI), which is need-based, SSDI benefits are determined by your work history and the amount of Social Security taxes you’ve paid over the years.

How Are SSDI Benefits Calculated?

No matter the program, disability benefits consist of two types of payments: a lump sum disability back payment and ongoing monthly benefit payments. This blog post describes how the SSA calculates monthly disability payments. Click here if you’d like to learn more about how the SSA calculates disability backpay.

Factors Influencing SSA Disability Benefit Amounts

Several key factors affect the amount of your monthly SSDI benefits:

-

Earnings Record: Your lifetime earnings that were subject to Social Security taxes play a crucial role in determining your benefit amount. Higher lifetime earnings typically result in higher benefits.

-

Average Indexed Monthly Earnings (AIME): The Social Security Administration (SSA) calculates your AIME by averaging your highest 35 years of earnings, adjusted for inflation. If you have fewer than 35 years of earnings, zeros are added to account for the missing years, which can lower your average.

-

Primary Insurance Amount (PIA): Your PIA is the base amount of your benefits, calculated using a formula applied to your AIME. This formula includes specific “bend points” that determine the percentage of your AIME used to calculate your PIA.

Calculating Your SSDI Benefits

The SSA uses a three-step process to calculate your monthly SSDI benefit:

-

Calculate AIME: Sum your highest 35 years of indexed earnings and divide by the total number of months in those years to determine your AIME.

-

Apply the PIA Formula: The PIA formula for 2025 applies the following percentages to portions of your AIME:

-

90% of the first $1,115 of your AIME.

-

32% of your AIME between $1,115 and $6,721.

-

15% of your AIME above $6,721.

These thresholds, known as “bend points,” are adjusted annually based on national average wage indices.

-

-

Determine Monthly Benefit: The sum of these calculations equals your PIA, which is the monthly benefit amount you would receive if you became eligible for SSDI benefits in 2025.

Example Calculation

Consider an individual whose AIME is $5,000. The PIA would be calculated as follows:

-

90% of $1,115 = $1,003.50

-

32% of $3,885 (the amount between $1,115 and $5,000) = $1,243.20

-

Total PIA = $1,003.50 + $1,243.20 = $2,246.70

This individual would receive approximately $2,246.70 per month in SSDI benefits, subject to adjustments such as the annual Cost-of-Living Adjustment (COLA).

Important Note: If you receive income from other sources, like a workers’ compensation program, a portion of those benefits may be subtracted against your SSDI payment. Happily, pension payments, private insurance payments, VA disability benefits, state government and SSI benefits DO NOT affect your SSDI payments in any way. Various rules apply so keep the SSA informed of any conflicts and consult a qualified disability lawyer if you have questions.

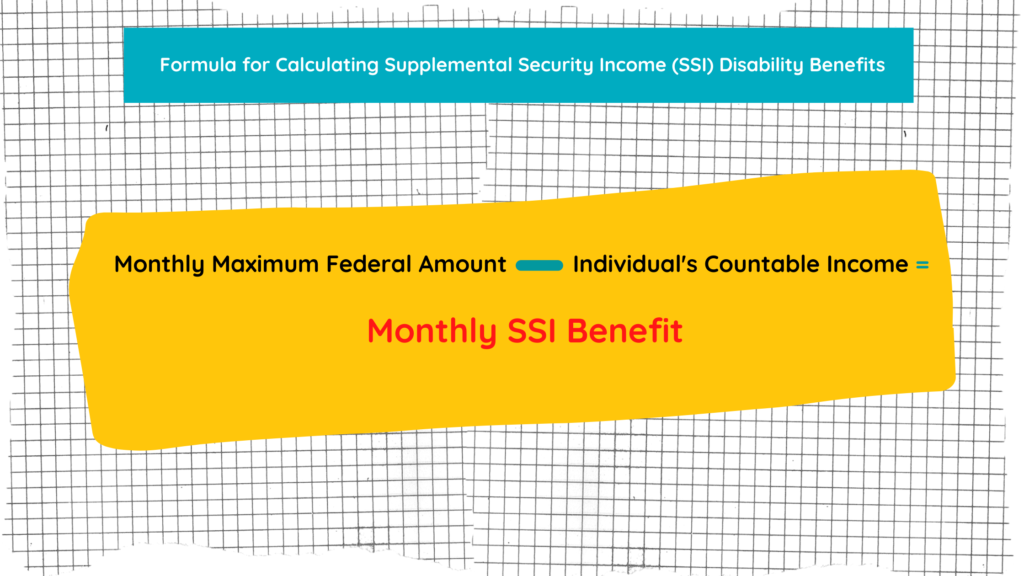

How Social Security Calculates SSI Disability Benefits

If you’re applying for SSI benefits and not the SSDI disability benefits, the process for calculating monthly benefit payments for the SSI program is straightforward. Each year, SSI establishes monthly maximum Federal payments. Those amounts increase every year with Social Security’s annual cost-of-living adjustments.

In 2025, the monthly maximum Federal amounts for the SSI program are $967 for an eligible individual, $1,450 for an eligible individual with an eligible spouse and $484 for an essential person.

But there’s more to the equation than just finding your monthly maximum payment category. Since SSI is needs-based, once an eligible claimant determines their max payment, they also need to consider any additional countable income they receive that SSA may subtract against their monthly maximum payment.

The SSA defines countable income as “anything you receive during a calendar month and can use to meet your needs for food or shelter.” Countable income may be in cash or in-kind which means not in cash – akin to someone offering you food or a free place to stay. The SSA also maintains a list of income exclusions that are not subtracted from the SSI monthly payment.

You can see the simple calculation for monthly SSI benefits illustrated below.

Cost-of-Living Adjustments (COLA)

SSDI and SSI benefits are subject to annual COLAs, which adjust benefits to keep pace with inflation. For 2025, the COLA is 2.5%, reflecting changes in the Consumer Price Index. This adjustment ensures that the purchasing power of SSDI benefits remains relatively stable over time.

Additional Factors Affecting Benefit Amounts

Several additional factors can influence your SSDI benefit amount:

-

Other Disability Benefits: Receiving other government disability benefits, such as workers’ compensation, may reduce your SSDI benefits.

-

Earnings While Receiving Benefits: Engaging in substantial gainful activity (SGA) while receiving SSDI can affect your eligibility and benefit amount. In 2025, the SGA limit is $1,550 per month for non-blind individuals and $2,590 for blind individuals.Disability Law Group

-

Family Benefits: Eligible family members, such as spouses and children, may receive benefits based on your earnings record, potentially increasing the total amount your family receives.

Tools for Estimating Your Benefits

The SSA provides online calculators to help estimate your potential SSDI benefits:

-

Online Benefits Calculator: Allows you to estimate your retirement, disability, and survivor benefits based on your earnings record.Social Security

-

Detailed Calculator: Offers a more precise estimate but requires downloading and installing software on your computer.Social Security

Utilizing these tools can provide a clearer understanding of your potential benefit amounts and aid in financial planning.

Conclusion

Determining your SSDI or SSI benefit amount involves a detailed analysis of your earnings history and the application of specific SSA formulas. While the maximum monthly benefit for SSDI benefits in 2025 is $4,018, individual benefits vary based on personal earnings records and other factors. Staying informed about the calculation process and utilizing available resources can empower you to better navigate the SSDI system and plan for your financial future.

Disability Lawyers in Charlotte, NC

Collins Price, PLLC, a North Carolina Social Security Disability law firm with local disability lawyers in Charlotte, NC, produced this blog post. We hope it was informative and helpful to you in navigating the Social Security disability process. Many claimants prefer to work with a disability lawyer to reduce the confusion and complexity of applying for disability or appealing denied benefits.

If you are unable to work due to severe physical or mental limitations, we encourage you to contact our disability lawyers in Charlotte, NC for a free consultation on your claim. There is no obligation to hire our firm and no fee for our services unless we win your claim.